State Farm® Testing Blockchain Solution for Auto Claims Subrogation

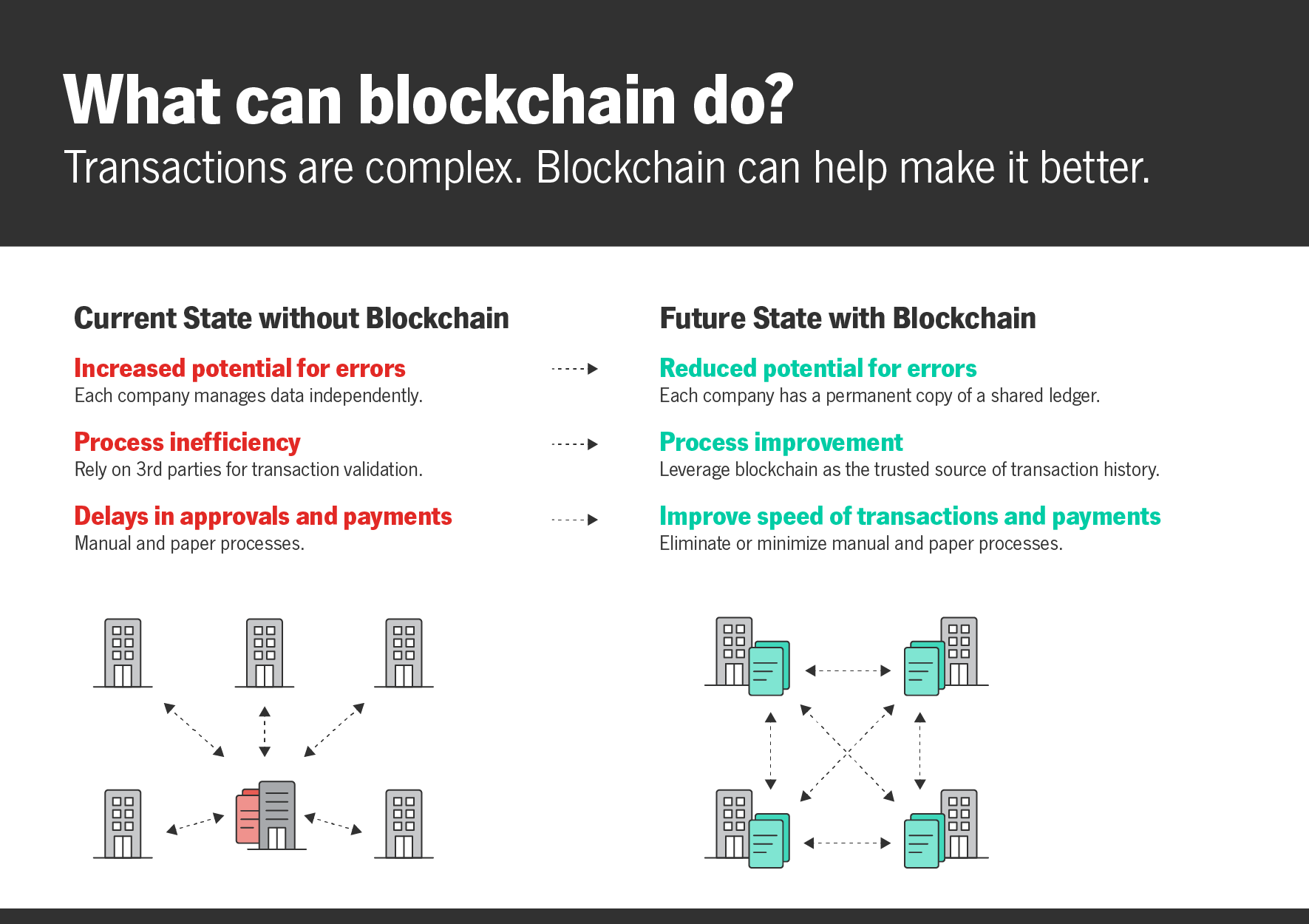

In an age of fast-paced technology, companies have to embrace innovation to meet the changing demands of doing business. That is why State Farm is investing in new technologies and start-ups to help more people in more ways, far into the future. To keep up with customer expectations, State Farm is working on a blockchain solution that could speed up the subrogation process for auto claims. The company is testing the solution against existing subrogation processes to determine if it can be a viable product for insurance industry adoption and bring value to customers.

“Today, subrogation is a relatively manual, time-consuming process often requiring physical checks to be mailed on a claim-by-claim basis between insurers,” says Mike Fields, innovation executive, State Farm. “You can imagine the time and resources required to complete these transactions.”

Companies across many industries are using blockchain technology to securely store data and manage transactions. State Farm is working with another insurer to understand how an enterprise blockchain solution can be used to reduce the time needed to complete the subrogation process by securely and automatically compiling all subrogation payment amounts, netting the balance and facilitating a single payment on a regular basis between insurers.

Benefits

“The blockchain solution we are working on has many potential benefits,” says Fields. “It helps us automate a manual process securely and creates a permanent transaction record of each payment which can easily be verified for accuracy. It also has the potential to decrease the amount of time for consumers to receive their deductible reimbursement.”

Subrogation is typically the last part of an insurance claims process where one insurance company recovers claim costs it paid to its customer for damages from the at-fault party.

What is Blockchain

Blockchain technology can be used to manage transactions and store information using cryptography (i.e., mathematical algorithms and secret keys that encrypt data), peer-to-peer networking and data storage. Subrogation is one example of where blockchain technology has the potential to reduce expenses while making processes more efficient and secure.

What is Subrogation?

Subrogation is a term describing a legal right held by most insurance carriers to legally pursue a third party that caused an insurance loss to the insured. In auto claims subrogation for example, information about the claim is collected and the two insurance companies negotiate the claim amount. If an agreement is reached, the at-fault insurer submits payment to the other insurer on an individual claim basis. No sensitive personal information is shared between the two companies.

For over 100 years, the mission of State Farm has been to help people manage the risks of everyday life, recover from the unexpected and realize their dreams. State Farm and its affiliates are the largest providers of auto and home insurance in the United States. Its more than 19,400 agents and 67,000 employees serve over 91 million policies and accounts – including auto, fire, life, health, commercial policies and financial services accounts. Commercial auto insurance, along with coverage for renters, business owners, boats and motorcycles, is also available. State Farm Mutual Automobile Insurance Company is the parent of the State Farm family of companies. State Farm is ranked No. 44 on the 2023 Fortune 500 list of largest companies. For more information, please visit http://www.statefarm.com.